Is It Better to Invest in Stocks or Real Estate?

In this article, I'll be answering the question: "is it better to invest in stocks or real estate?" I'll provide information on how money is made, how much you can make, and my personal pick.

Knowing you want to invest is simply the first step in an extraordinarily complex yet rewarding game. Often finding exactly what to invest in can be the biggest challenge. Stocks or real estate? These seem to be the two most popular methods of investment, and either one can be very rewarding and profitable if managed correctly. So, which is better for you?

There are many factors to consider when choosing a type of investment strategy. How much time are you willing to dedicate to the ongoing management of your investment? Also, how long term are you thinking? Are you wanting a shorter investment that bring in a quicker return? Or looking to build wealth slowly over time?

There is not going to be a set answer as to which is better, rather you need to consider your individual circumstances and expectations.

How Much Money Can Be Made Investing in Stocks?

When we talk about reasons for investing in stocks, it is a good assumption to say that money is the main motivator. So, the question should not be ‘should we invest in stocks’ rather, ‘how much money can be made’. Because no one invests for the sole fun of it. So how much money can be made? This depends on a little bit of strategy and a little bit of luck.

One main benefit of investing in stocks over real estate is that it can be easier to start small. You do not need a large amount of startup capital to begin with stocks, however the smaller your investment the smaller your returns. If you are looking to make serious money in the stock market, you will need to invest large, invest smart, and factor in compounding over time. And of course, you are always at the mercy of the stock market, which is very rarely in your control.

There is also a lot of guess work in stocks. Ideally you would want to purchase stocks at a low price, have them skyrocket in value, and then sell at a huge price. Of course, sometimes the opposite happens, and you will lose the value of your investment. So, on the surface, stocks may appear to be less work than real estate, but in order to make money from them, you either need a lot of luck, work very hard at managing them, or have a good system in place.

Investing in Real Estate Over Stocks

For very similar reasons that someone might invest in stocks, they could also use to justify investing in real estate. Some might prefer that real estate seems more real, as there is a physical asset to view and manage. Real estate investments do also give unique benefits which are highlighted by Investor Junkie as being rental income, tax advantages and capital appreciation gained by buying below the market value.

Rental income is of course one unique advantage over stocks, and this can be both a blessing a curse. Rental income is never guaranteed – it all depends on not only having a tenant in the first place but having one that will pay on time and look after y our property. You will see some real horror stories from landlords about destruction and financial hardships invoked on them by their tenants.

A good tenant can really make or break a real estate investment.

Even if you invest in a syndicate or a real estate investment trust (REIT), you will still be at the mercy of tenants (whether residential or commercial).

For me, the largest benefit of real estate is appreciation of the entire property.

As an example, I'll discuss the typical home buyer.

Let's say that Michael buys a home and puts in 20% into a $500,000 home. While the down payment is $100,000, the entire home is appreciating. Yes, Michael may be paying into a mortgage, but the overall price of the home could double, not just the amount that Michael paid into the down payment, mortgage payment, and related expenses.

Here's another example. A friend of my asked me if I wanted to buy his house in Cupertino, California for $350,000. This was roughly 20 years ago. Now, that home is valued at over $2.2 million. If I bought that home back then, my down payment would have only been $70,000. That isn't a typical real estate example for most of the United States, but hopefully you understand how powerful this concept is.

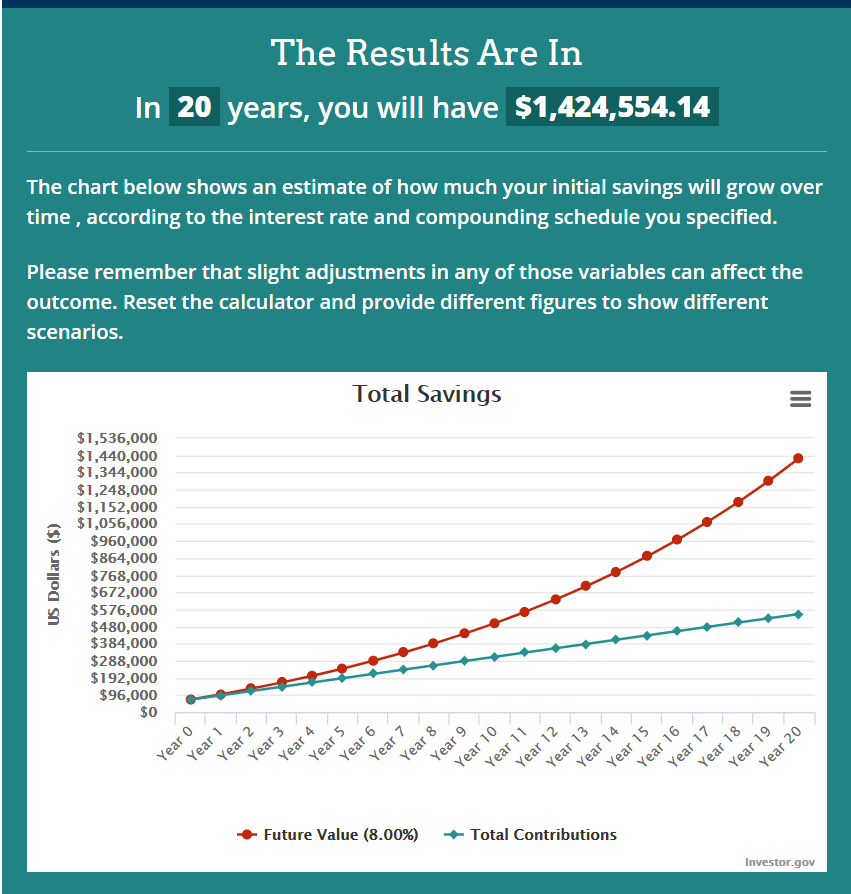

To illustrate this, I plugged in some numbers at Investor.org's compound interest calculator.

I wanted to see how much I would make if I invested $70,000 into the stock market, and added $2,000 every month. The 2K represents the money that I would have put into mortgage payments. This is just a rough calculation at 8% growth and it's being shown for informational and educational purposes only.

The result is 1.4 million after 20 years. At 6%, it would have been 1.1 million. In order to hit 2.2 million, the rate of growth would have to be close to 11.4%, and that's not factoring in taxes.

Which is Better – Stocks or Real Estate?

Unfortunately, there is no clear answer to this question. Whether investing in stocks or real estate is better for one person, might be different for another. There are so many factors that can influence how successful an investment is. There is evidence that supports both stocks and real estate as being a good form of investment, so you can feel secure in whatever choice you make.

While it is true that both stocks and real estate are considered sound investment strategies, Investopedia does mention that historically, real estate investments do generally offer lower risk, yield higher returns and provide greater diversification.

For long term, more secure investments the experts do all seem to go towards real estate investing. Again, this is personal and will not guarantee success. There have been plenty of people who have found more success in stocks than real estate, and same with the opposite.

How to Choose Between Stocks or Real Estate?

Although it may appear on the surface that investing in real estate is a better choice, there is a reason why stock investment remains the most popular method. Nerd Wallet explains that stocks are extremely liquid, so they are very appealing to many first-time investors. However real estate gives you an asset to manage, and so can be easier to understand and manage.

The first step in choosing between investing in stocks or real estate is to ensure that you have a clear understanding of the requirements and the risks. Your decision needs to be an educated one, not what your family or friends tell you is better. You need to be comfortable in your decision, or you will be asking for failure.

Keep in mind that not everyone can afford a large down payment. While you can invest in real estate through other instruments such as a mutual fund, it doesn't have the same financial impact as investing in your own property.

If an individual had sufficient funds for a down payment and was considering investing for the long-term, my personal pick would be real estate.

If you're just starting out and you want to test out the market with a small amount of funds, investing in stocks would be a great way to get started.

Conclusion

The decision to invest in either sticks or real estate really depends on the individual.

One person’s financial situation, tolerance to risk and preferred investment style can influence the investment choices they make. There is no right answer when it comes to investment. No matter what you choose, follow it through, mitigate any perceived risk, and manage your money well. Investments of any type are a good way to set up for your financial security.