The Essential Guide for Paying Off Debt Fast

Can you imagine a life with no debt? What if you could get rid of all of your credit card bills, car payments, or pay off your school loans? Here are my top strategies for wiping the slate clean!

Today you're going to learn how to pay off debt as fast as possible. I'll go over my strategy of how I went from over $55,000 (USD) in debt to $0 in less than 2 years ...and a lot more. My goal is to help you get out of debt in as little time as possible. I understand that not everyone can follow the same exact plan that I used myself. That's why I've included many other strategies that you can hopefully use for your situation.

Get Set for Financial Freedom!

It doesn't matter if you're wanting to pay off your credit cards, mortgage, college loans, or any other type of debt. Once you do, you can move towards becoming financially free!

In this guide, it's my hope that you'll be able to stay away from bankruptcy, feel like your on solid ground, and feel totally awesome knowing that you'll never get into serious debt again.

Let's face it, being at the rock bottom really does suck. If you're not there, even saving a few hundred a month doesn't feel like it's enough when you considering what it really takes to survive during your retirement years.

If you're living here in the U.S., having a million dollars might seem like a lot, but consider having a nest egg that will pay for costs of living, medical bills, fun during retirement, and then more due to inflation.

How can you enjoy your retirement for 10, 20 or even 30 years without working for a living?

To get to that point, here are...

My Golden Tips for Paying Off Debt and Becoming Financially Independent!

Every success story requires active participation and a level of sacrifice. And so, to achieve financial freedom, dedication is crucial. It isn't enough to have goals. It's more important that you work hard to reach those goals.

If you want freedom from all financial burdens, there’s no better time to start than now.

Having Money Does Not Get Rid of Debt!

For most of my childhood, I thought that having a lot of money would fix all of my family's problems.

Have you ever heard of those stories about people winning millions from the lotto or celebrities making it big, but then end up losing it all?

Why does this happen?

The simplest answer is: mindset!

People that are rich think about money in a different way compared to people that are poor.

I remember reading a book called the "The Millionaire Next Door" by Thomas J. Stanley and William D. Danko which analyzed the habits of over 500 millionaires. One of the key habits was to not spend money on depreciating assets like status objects. So instead of buying a Mercedes or a Lambo, one of the most popular vehicles for these extremely rich individuals was a Ford F-150 pickup.

The same thing goes for living in a neighborhood just to be part of a social class. Being surrounded by a bunch of people that are "Keeping Up With The Joneses" can have ill effects on your finances.

How a Poor Mindset Can Greatly Impact Debt

When I accumulated over 55K in debt, I was a silly college student. I thought that I could spend a lot because I was going to make a bunch more after I graduated.

During my 1st week of college, I noticed a bunch of booths from various companies - mostly banks. They were giving out schwag like Nerf footballs, Slinkies (huge plastic toy springs), and t-shirts. In order to get this free cool stuff, I ended up signing up for credit cards. I was thinking that I had to build my credit score since I had none.

I signed up for more cards, bought school supplies, and used it for travel and party cash. That was all in addition to the college loans that I pulled out.

At first, it didn't seem like a lot. It was the first time that I started to pay for recurring expenses. I thought that was the role of an adult. After all, I saw my parents paying off credit card bill, their mortgage, and other debt throughout my childhood.

I was focused on paying the minimum payment. It started off with small $20+ payments, then eventually over a hundred, then it snowballed to an amount greater than my rent.

When More Income Creates More Debt

After getting a full-time job, my cheap college apartment wasn't good enough.

My used car wasn't good enough.

My home stereo wasn't good enough.

As my income increased from $10,400 a year to $56,200 a year, my standard of living was increasing as well.

With all of that debt, my minimum payments increased and so did my interest. I was spending so much on paying off interests instead of the principal.

My mindset didn’t really change until a college friend invited me to a financial workshop. There were 3 big takeaways from that event:

1) Most people that retire don't have enough money.

2) Most people can accumulate over a million dollars in their lifetime using the power of compound interest (as she had done).

3) Most people make a bunch of financial mistakes because they don't learn how to manage their finances...even in school.

Number 3 hit me the hardest. I realized that throughout my whole school life, including college, I never understood how to manage my finances. All I knew was that saving was good and that debt was bad. However, I was deep in debt and I questioned myself. "Why am I this far in the hole financially?"

I realized that I had to make a huge change. I realized that I wouldn't be able to accumulate 7 figures if I continued this path. I realized that I might be one of those poor statistics of not having enough for retirement if I didn't educate myself to improve my situation.

I thought about this for several weeks and I felt so strongly about getting out of debt as fast as possible.

Even though many of my friends that took out loans for college had a 10-year payoff plan, I realized that I wanted to start creating my golden nest egg for retirement. So I ignored that 10-year plan and settled for a 2-year plan.

Now enough about me.

What Is Your "WHY"?

Why is your "why" so important? Understanding yourself and where you want to go will be your north star. Having this major goal (or set of goals) will help you stay the course in becoming debt-free.

It's a huge challenge. There will be many things in your way. As you might have noticed in my story, "I" was my worst enemy. I take full responsibility for what I did to myself.

I know that I had parents that were in debt. I know that the school system didn't teach me about personal finances. However, I know that I'm not a victim. I know that I made my own decisions that shaped my future.

Seeing friends take nice vacations, go to nice restaurants, buy nice cars are all temptations. Instead of being part of that kind of me too movement, what can you do to make a positive difference in your future?

Is there something deep and personal to your situation?

One of my mentors, Tony Robbins, mentioned that there are 2 things that motivate us: pain or pleasure.

For me, it was intense pain! I saw an extremely dark future of not having enough money to have a family, a home, and to retire. It was enough to make me take the quantum leap.

Once you determine your "why," you must make a serious decision to make a positive difference in your life by eliminating your debt.

“It is in your moments of decision that your destiny is shaped.” - Tony Robbins

As Tony mentions, the decisions that you make will shape your future. Your decisions are really that powerful!

Are You Living Within Your Means?

One of the biggest financial mistakes is spending more than what you earn. With all of the credit card and loan opportunities, it's so easy for people to get into this rut.

For me, buying luxury items with debt was the norm. I watched my parents buy RV's, high-end electronics, and new toys year-after-year using credit cards and loans. I thought it was normal to do the same until I realized that thousands of dollars from my earned income was going into interest.

Here are a few key pointers:

- In your budget, identify high priority payments

- Identify things that you pay beyond your monthly budget.

- Identify habits that are getting you into debt. Consider what you've mentioned in #2.

- Replace money-robbing habits with habits that help you save money.

- For example, if you're buying a premium latte every day, consider buying a smaller version or getting house blend coffee instead. Perhaps you can make your own coffee at home to save money.

- Another example is for shoppers. If you're going to the mall once or twice a week, what can you do to reduce the number of times you go each month. While it might make you happy, there are other things that you can do that are more economical and fun as well.

- Use coupons, discounts, rebates, or money-saving apps. While I'm not much of a coupon cutter, I do use an app for earning cash back. It's called Rakuten/Ebates and you can earn money just by shopping offline and online. When I go to the mall, I'll turn on their app and look for deals nearby. Since I've linked my credit card to the app, I just use my linked card in the store to earn cash back. Online, I simply search for deals and then click on a link from their website. At the time of writing this post, I was able to find deals for popular stores like Amazon, Walmart, Target, and Macy's.

- Find ways to reduce your temptation.

- This might mean driving a different path to avoid seeing a shop.

- Not hanging out with certain friends that make you feel like you have to spend more money.

- Reduce pricey hobbies or the frequency of them.

The key points are focusing on your priorities and replacing money-happy habits with habits that can make you happy without spending so much.

Key Attitudes and Beliefs for Becoming Debt-Free

"Never spend your money before you have it."

-Thomas Jefferson

Some may think that getting out of debt is easier said than done. What if you could make it easier? The feeling of pain or frustration is a mental state that can be improved upon by using self-enhancement technologies. The 2 that I've used with great success are affirmations and visualizations.

Using Affirmations

When I first started using affirmations, I felt kind of strange since the books that I've read mentioned to look into the mirror while saying them. I took a different approach by using them for self-talk or self-motivation. So whenever I feel that I'm going against the right attitudes and beliefs, then I'll interrupt them with an affirmation or through visualization.

If you've never done or heard any of this before, it might seem a bit strange or unnatural. Well, it is - but it works!

Have you ever been in a situation where you felt so sleepy or sick and didn't feel good? There's a good chance that you have. Now let me ask you this...have you ever smiled while being sick or very sleep? Do you remember having a fun time even with a lack of sleep or being sick? It is greatly possible and what we say to ourselves, what we think to ourselves, and what we're experiencing has a huge impact on how we feel and what we do!

Here are my key affirmations that will help you become debt-free:

- I will not use my credit card or loans as income.

- My plan is to pay off my full credit card balance each month.

- I will not spend more than what I have.

- I will focus my spending on what I need instead of what I want.

- I will track every single dollar and penny that I spend.

- I understand how hard it is to earn money. I will think twice about what I spend my money on and how it can provide long-term value.

- Spending money on short-term joy can lead to long-term debt.

- I will prepare my meals from home.

- I want to create a legacy for my family and will save for multiple-generations to come.

- I am becoming more frugal to enjoy a debt-free life for the long-term!

Those core beliefs and attitudes from those affirmations may not be what you represent right now, but I believe moving towards them will help you reduce your debt as it did for me. Even after a decade of being debt-free, I still follow the majority of these beliefs. I do have more flexibility nowadays with discretionary income, so there will be times where I do spend more than usual. With that being said, I still live within my means.

Think about the core beliefs and attitudes like a habit muscle. The more you work on improving it, the better you'll be. Back in the day, a popular self-help guru named Maxwell Maltz said that it takes around 21 days to develop a new habit. In a recent study, it was mentioned that it takes 66 days to develop a new habit (source). Whether it's 1 month or 3 months, the main thing is to do your best and improve your habits over time.

Using Visualization

I've tried various strategies for imagery and rich visualization for developing new habits. What's worked for me is making things as real as possible. So if you were to close your eyes, you would visualize yourself having these key attitudes and beliefs from your mind's eye. So you wouldn't actually see your face as that isn't realistic. You would see things, hear things, and feel things from a 1st person perspective. So right after waking up and right before going to sleep, I would think about different scenarios where I made better financial decisions. So twice a day, I would perform this exercise for 1-5 minutes and sometimes until I fall asleep. This process has similarities to meditation and using the "alpha state" to program your brain. This kind of reminds me of that movie - "The Matrix" :)

Know What It Takes to Pay-Off Your Debt

I call this reverse-engineering your debt. Before we dive into your monthly budget, you should have a rough idea of how much it will take to reach your debt-free goal.

Here's some quick math:

Total debt / (Number of Years x 12) = rough amount of each monthly payment*

For my situation, I was $55,000 in debt.

My goal was to pay off all of it in 2 years:

$55,000 / (2 years x 12) = 55000/24 = 2291.67*

So this means that I'll have to pay at least $2,291.67 a month for 24 months. I say "at least" because that amount doesn't include interest*.

We don't need to do any complex financial calculations just yet. This calculation is just for awareness purposes. Before you make a detailed decision, you have to determine if the monthly payment is realistic or not.

For me, over $2000 was a lot of money to pay into credit card debt and school loans each month. I had to figure out how to make extra money just to pay off my bills.

Prepare a Monthly Budget

I call this reverse-engineering your debt. Before we dive into your monthly budget, you should have a rough idea of how much it will take to reach your debt-free goal.

Have a plan! Don’t worry, it’s not rocket science. Budget preparation is easy! Here's what you need to do at the start of every month:

- Grab a notepad and write down your monthly income.

- On the next line under your monthly income, itemize your bills. For example, you would write down your cost of utilities on one line and your rent or mortgage payment on another. It should be something that is due every month. After you write down all of your monthly debt, subtract the total amount of debt from your monthly income.

- Keep subtracting by listing down more dues. Include anything paid on an installment basis. How about the car you use to go to work or even your Netflix subscription? Never forget to fulfill credit card obligations. Charges for delayed payments can harm your budget.

- Next on the list should be the basic necessities, other debts, and miscellaneous fees. Include other expected expenses such as your kids’ upcoming school projects.

- Do subtraction until there is none left to list or if the difference reaches zero.

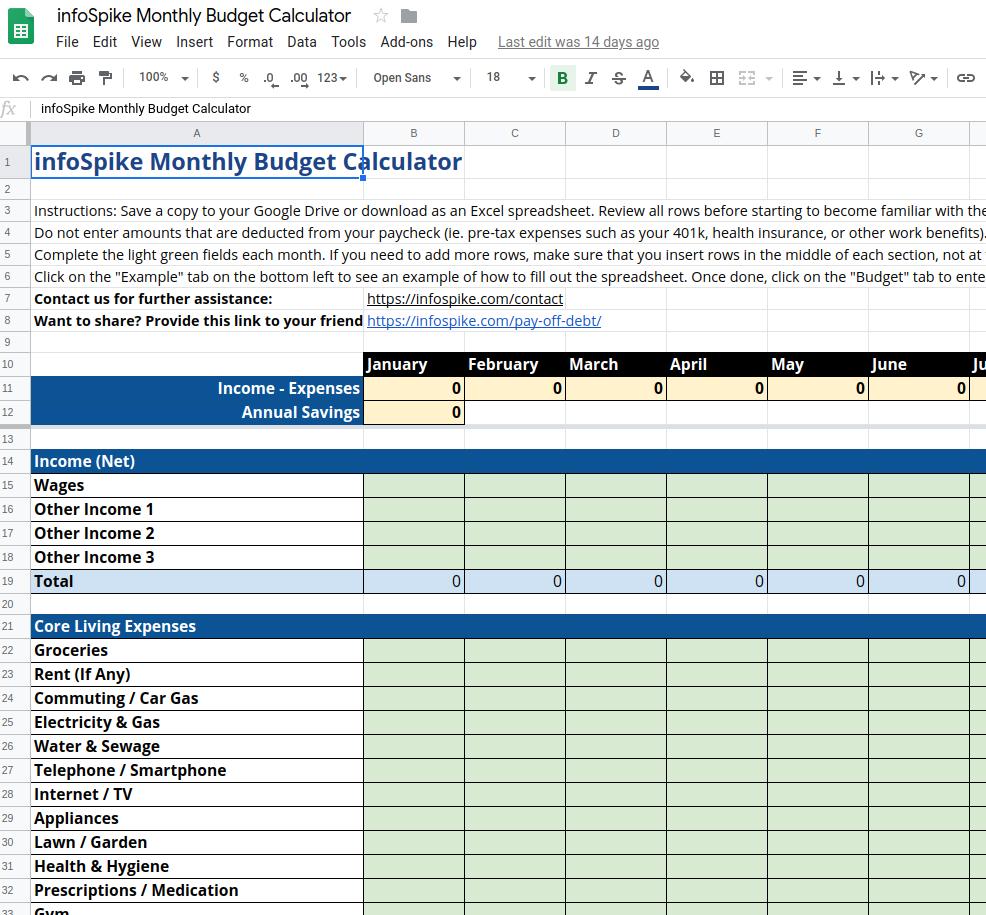

If you'd like to create a monthly budget the easy way, check out our infoSpike Monthly Budget Calculator (MS Excel Spreadsheet). All you have to do is enter your values into the spreadsheet and it will automatically perform the calculations for you.

Start a Side Hustle

Creating a side hustle is high on my list because it's the main method that I've used to get out of debt. For example: when I was going to college to complete my 4-year degree in engineering, I was told that it would take about 10 years to pay off my school loan. At the time, I was thinking that I would make a lot of money as a professional. So what did I do after I graduated? I made more, spent more, and accumulated about 50 grand in debt. I knew that I had to change my spending habits and pay off my debt fast. So I started my side hustle and ended up paying off my debt in 2 years instead of 10.

So let's go over what a side hustle is all about!

If you want financial independence, work harder for it. If your current income isn't enough to pull you out of the debt pit, think of other ways to earn more income.

Find a side hustle or even a second job to generate more income. Put your skills into good use. Can you write? Manage a professional blog. Do you do web designing? Do freelance work in your spare time. Are you good at fixing things? Get yourself out there and offer your services. Take advantage of social media to let people know that you have the skills they need.

Can’t think of any skill? Then look around and see what ideas you can come up with. Sell stuff that you don’t need, for instance. Do a garage sale. That will declutter your house and earn you some money at the same time. Bake your special cupcakes and accept orders. You’ll be making money doing what you love. In other words, consider any of your interests and create a business out of it.

Yes, side hustles can be very tiring. But once you achieve zero-debt, it can also be very satisfying. It would be even more satisfying when you finally become stable and financially free! You never know...your side hustle could eventually become your full-time gig.

The Snowball Method for Paying Off Your Debt

You might have heard of the question: "How do you eat an elephant?" The answer is that you take one bite at a time.

While I would never eat an elephant, the saying applies to many things such as accomplishing huge goals. If you have several credit cards and loans, it feels better to see the quantity of your debt decrease over time. By paying off the smallest debt first, you'll feel the accomplishment and it will help motivate you to continue paying off your debt.

So here's the snowball approach:

- List the balances of all of your debts. These can be credit cards, car loans, school loans, mortgages, or whatever debt you might have.

- Sort the list from smallest balance first.

- Pay off the first one on the list.

- After paying off the first debt, you'll have extra money. Now apply that to the second debt on your list.

- Pay off the second debt and apply the extra money that you have from paying off the 1st and 2nd debt to the 3rd on the list.

- From there, rinse and repeat until you've paid off all of your debt.

Paying off debt does feel good, but I'll go the approach that I used.

The Debt Avalanche Approach for Paying Off Your Debt

With this approach, I'll show you the most effective method for paying off your debt. This approach is focused on paying off debt with the highest interest rate. You can use the annual percentage rate (APR).

- List all of the balances, interest rates, and minimum payments for all of your debt.

- Sort the list with the highest interest rate at the top of the list. So it would be a descending order, greater to smaller.

- Pay the minimum on all debt except for the one at the top of the list.

- Pay off the highest interest rate debt as fast as possible.

- Once the first debt is paid off, then continue down the list and do the same.

- Rinse and repeat until you've paid off all of your debt.

While you won't be closing out accounts faster than the traditional snowball approach, you'll be getting rid of the debt that is robbing you of your money through high-interest payments. Using this approach, you'll be able to pay off your debt faster instead of throwing your hard-earned money out the window.

If your highest-interest debt has a higher balance than the rest of the list, then you can try a hybrid approach by focusing payments on #2 or both #1 and #2.

Monitor and Manage Your Credit Card Usage

What gets measured, gets managed.

- From Peter Drucker's book - “The Practice of Management"

Overspending is not something you do, it's something that you think of. At least, not on a regular basis. Well, it could be something you have not realized yet. And it would be more problematic if you’ve been using your credit card.

Claire Tsosie listed these signs of overspending with your credit card:

- "You’re falling behind on savings goals." If you're saving up for a new home, retirement, or even for emergency expenses, overspending goes against your savings goals.

- "You’re buying out of boredom." - Have you ever used shopping as a way to cure boredom or even depression?

- "You’re breaking your own spending rules." - You've created a monthly budget and set some rules for yourself. Then you find yourself breaking your own rules.

If you're stuck in the overspending rut with your credit card, it's easier to fall into this bad habit if your card is easily accessible.

While you're in the process of paying off your credit card debt, stash your card away or make it harder to use. Keep more cash on hand for your purchases. After you've paid off your debt, do what I do: autopay your full balance each month. This will help boost your credit score.

Kill Multiple Birds with 1 Stone: The Power of Debt Transfers and Debt Consolidation

While I was in huge debt, I had over a dozen credit cards from different banks. They were sending me junk mail throughout the month so that I would sign up for their other financial offers. At first, I considered all of that mail junk. Then something caught my eye:

Pay 0% Interest for 24 Months!

I ended up transferring as much debt as I could into that special credit card offer.

If you're using a loan to do this, it's often called a debt consolidation loan. If you're using a credit card, then it's just transferring the balance of 1 or more cards. Most of my debt was credit card related, so I was able to transfer credit card debt into another card. With non-credit card debt, this may not be possible so you'll need to look into lower-interest loans.

Here's what's great about this strategy:

- You can transfer high-interest rate debt into a card with a lower interest rate. I had a few cards with an APR above 20%. I transferred them into the new card with 0% for 2 years, and then the interest rate was set at a variable interest rate of 12%. Since the rate is lower, you'll be able to pay off your debt faster.

- It simplifies your debt payments.

While you're using this strategy, look out for the cost to transfer your debt (which may be in fine print) and also look for other debt consolidation or credit card transfer offers. It's possible to chain 0% or other low-interest offers across multiple years through different bank offers.

Conclusion

I won't lie, paying off your debt is a great challenge. However, you can utilize many of the tips that I've provided to lighten the load and move towards your financial goals faster!

Paying off my debt was painful process, but the rewards were well worth it! I no longer have to worry about unexpected expenses since I have a heft emergency fund. With my retirement savings, I'm on path to retire with a higher level of income that I currently make. I haven't felt the stress from paying hundreds or thousands of dollars each month into interest and finance charges.

This is version 2.0 of my Essential Guide to Paying Off Your Debt and I hope you liked it. It's my goal to improve this over time and make it the best guide on the web! If you have more questions on how to pay off your debt, feel free to contact me.